Introduction

Jointly Owned buildings as well as other buildings are exposed to a host of hazards such as earthquakes, floods, leaks, fires and malicious actions.

The Management Committee of each Jointly Owned building, in accordance with the mandatory insurance of Jointly Owned buildings, as provided by the Law, must always keep the Jointly Owned building insured against fire, explosion, lightning and earthquake for an equivalent amount to its replacement value.

The policy covers

The Jointly Owned Property Package All Risk policy covers the entire value of the Jointly Owned building except the land value on which it is built as well as the property belonging to the units (apartments), at their replacement value. Also covered are the Machinery and Equipment and Facilities of the Joint Building such as elevators, central heating, air conditioning, depots, satellite antennas, etc.

The policy is addressed to

The management committees of Jointly Owned buildings which according to the legislation are obliged to insure the communal property, but also to the owners of the units of the Communal Building to insure their own property.

What it covers

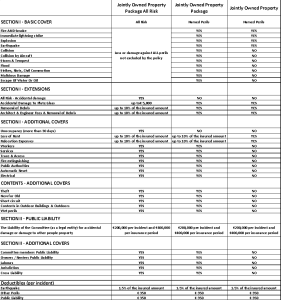

All the coverages of the Jointly Owned Property Package All Risk policy, as well as the covers of two other insurance policies for Jointly Owned buildings, are shown below. We strongly recommend the Jointly Owned Property Package All Risk policy.

Excel Table Jointly Owned Property Package All Risk

Frequently Asked Questions

Who is responsible for insuring the Jointly Owned Property?

According to the Law, “The Management Committee” must insure and always keep the jointly owned building insured, against fire, explosion, lightning and earthquake, with a licensed insurer for the amount that the Management Committee considers to be equivalent to its replacement value. For any other risks insurance is mandatory, only if this is decided by an ownership percentage in excess of 50 percent (50%).

What other insurances should a Management Committee have?

In addition to the risks of Fire, Earthquake, Explosion and Thunderstorm, the Management Committee shall take out any other insurance required by any other law. Examples of such are Public Liability Insurance for any liability that may arise from bodily injury or damage to third party property, as well as Employer’s Liability Insurance if employing any staff over eight hours per week. Liability insurance is included in the Jointly Owned Property All Risks package, Jointly Owned Property package and the Jointly Owned Property policy shown above.

How are the members of the management committee personally protected from any errors and omissions they may commit?

The policy coverages can be extended to cover the personal liability of the members of the management committee.

What buildings are considered as Jointly Owned buildings?

A building is considered jointly owned when it consists of at least five units, even if it with all its units is owned by one owner. In addition, a building can be characterized as Jointly Owned when the owners of at least 50% of the Jointly Owned property or any owners of two units of a building consisting of two to four units request it from the Director of the Department of Land and Surveying.

Should I be aware of anything during my Insurance Cover?

In order to properly insure your property, you should inform the Insurance Company of any change in data, such as a change of ownership of the insured property, change of address of the insured office/store, any increase/decrease in the contents, change in the use of the house, extensions or repairs made to the building which are likely to increase the risk.

What should I do in case of damage?

Contact the Insurance Company immediately bearing in mind the following:

If it is a fire, notify the fire department.

If it is malicious damage or theft, notify the Police.

Do not repair any damage or dispose of any damaged item prior to inspection by the Company’s Appraiser. If you need to make any temporary repairs to prevent further damage, keep the relevant receipts.